Section F. The Basics of NFIP Flood Insurance Policies

It's valuable for elected officials to have a basic understanding of NFIP flood insurance policies, including which buildings can have policies, why banks require some property owners to buy policies, how much coverage is available, and the fact that policies on buildings in mapped flood zones include coverage to help pay the cost of bringing buildings that are substantially damaged by flooding into compliance. You may also find it useful to know the factors used to rate policies, how flood map changes affect policies, and how the financial security of insurance compares to disaster assistance.

Home and business owners are often surprised to learn their general property insurance policies do not cover flood damage. Similarly, renters do not know that renter's insurance doesn't cover contents when damaged by floods. Most people learn this hard lesson after floods occur. Fortunately, access to flood insurance is one of the fundamental reasons communities participate in the NFIP. The readily available policies provide property owners with consistent, affordable coverage to protect against financial losses caused by flooding.

Many property owners and renters obtain NFIP flood insurance from the same companies that write their property insurance policies. Those private insurance companies, which also deploy claims adjusters after flood events, operate under agreements with the NFIP. Some property owners obtain NFIP policies directly from the program.

Communities use a variety of methods to inform and encourage owners to obtain flood insurance policies, focusing on the important message that "General property insurance doesn't cover flood damage." The NFIP provides many websites, videos, fact sheets and brochures written for property owners and policyholders, including many translated to Spanish. These materials offer detail on the availability of flood insurance, mandatory purchase, coverage (amount of insurance available), and filing claims, with a focus on actions owners should take before, during and after floods. A good starting point to find materials is www.floodsmart.gov.

Some topics covered by the NFIP materials include:

Some topics covered by the NFIP materials include:

- What property owners need to know about flood map changes and flood insurance

- Summary of coverage for homeowners and business owners

- Cleaning up after the flood

- Flood insurance claims process

- What owners need to know to build back safer and stronger

The NFIP Claims Handbook provides tips for policyholders about what to do before and after a flood, including understanding the coverage, documenting damage, talking to insurance agents, things to do right after flooding occurs, learning about Increased Cost of Compliance coverage, and filing and handling claims and appeals.

Check "Policy Information by State" to learn how many buildings in your community are insured by the NFIP and look up "Claim Information by State" to find out how many claims have been paid in your community since 1978 at https://www.fema.gov/about/openfema/data-sets#nfip.

Most automobile insurance does not cover flood damage.

Flood damage isn’t just about buildings. After Hurricane Harvey, the Texas Department of Insurance reported to the State Legislature that more than 200,000 personal and commercial automobile claims were filed, of which more than 130,000 were total losses. Total claims would exceed $2 billion. While auto policies may cover flood damage, events that trigger large claim payments can drive up the cost of premiums for everyone. Plus, claims rarely pay enough to replace cars, making it harder for citizens to recover.

29. Where is NFIP flood insurance available?

NFIP flood insurance is available in 22,300+ communities that participate in the NFIP. Property owners in these communities can purchase NFIP flood insurance policies from private insurance companies and local insurance agents that participate in FEMA's Write Your Own program. Flood insurance coverage may be obtained for all insurable buildings regardless of location in mapped "high risk" floodplains or in "low and moderate risk" areas outside of mapped flood hazard areas identified on NFIP Flood Insurance Rate Maps (see examples of maps in Question 26). The only limitation is that policies are not available for new construction and substantially improved or repaired substantially damaged buildings in federally-designated Coastal Barrier Resource Act areas.

- "High risk" flood hazard areas are identified as Zone A, AE, A1-A30, AO, AH, A99, and AR or Zone V, VE, V1-V30 and VO.

- "Low and moderate risk" areas are identified as Zone X (shaded) and Zone X (unshaded). On older FIRMs, these areas are identified as Zone B and Zone C.

Common misunderstandings about NFIP flood insurance.

Two common misunderstandings can lead owners to make the wrong decision about flood insurance. They may have been told flood insurance isn’t available for buildings located in the mapped floodplain, or for buildings outside of the mapped floodplain. Sometimes even insurance agents don’t realize NFIP flood insurance policies may be purchased for all insurable buildings. See Question 20 for more information to counter myths and misunderstandings.

30. How does flood insurance compare to disaster assistance and loans available after flood disasters?

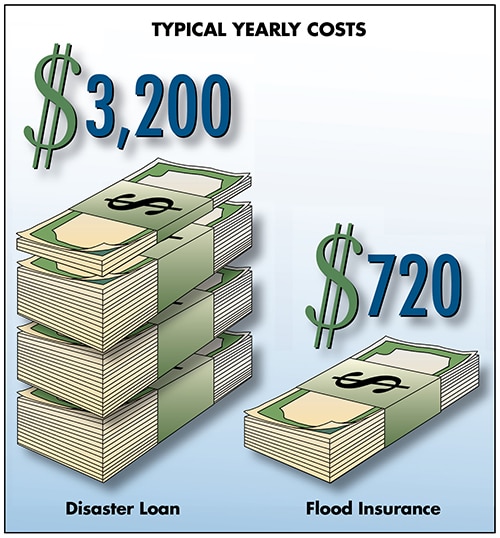

Flood insurance is a dependable way for property owners to obtain protection against financial losses, rather than rely on small amounts of disaster assistance and loans that require repayment.

Flood insurance claims are always paid when insured buildings are damaged by qualifying flood events, even small floods that affect only a few properties. In contrast, most federal disaster assistance is available only after flood events are declared major disasters by the President. When property owners are not insured for flood damage, FEMA's Individuals and Households Program provides small grants, but the funds do not cover losses to damaged and destroyed buildings. The Small Business Administration usually offers loans that must be repaid.

Hurricane Harvey illustrates the value of flood insurance.

As of July 31, 2018, the average claim paid by the NFIP for Hurricane Harvey flooding was more than $115,000 (Insurance Information Institute). By comparison, the amount of assistance FEMA’s Individuals and Households Program (IHP) can provide a survivor or household as a result of declared disasters is limited to $33,300. For Hurricane Harvey, the average housing assistance was just under $9,000 for owners and $2,000 for renters (and much less for Hurricane Irma). Assistance to repair owner-occupied primary residences is intended to make damaged homes safe, sanitary and functional. This assistance does not pay to return homes to pre-disaster condition.

31. Why do mortgage lenders require some property owners to buy flood insurance?

The NFIP statute requires federally regulated or insured lenders to require property owners with mortgages on buildings located in FEMA-mapped flood zones to purchase and maintain flood insurance policies for the life of loans. This requirement is called "mandatory purchase." If a property owner doesn't obtain a policy within 45 days of receiving notice of the requirement, then lenders may "force-place" coverage (buy policies). Force-placed policies usually are more expensive than when owners buy their own policies. Even though not required by the NFIP statute, some lenders may require borrowers to obtain flood insurance on buildings outside of the mapped floodplain.

Most flooded buildings are not insured for flood damage.

Despite the mandatory purchase requirement, the NFIP estimates only 10-20 percent of buildings damaged by flooding in recent years had flood insurance policies. It is helpful to know how many buildings are in your community’s mapped floodplains, and how many are covered by NFIP flood insurance policies. This information helps you understand your community’s exposure to flooding and potential financial loss if uninsured citizens are flooded. This information may be found in your hazard mitigation plan. NFIP policy and claims data, by state and community, are online at https://www.fema.gov/about/openfema/data-sets#nfip.

32. How much coverage for individual buildings is available from the NFIP?

The NFIP offers flood insurance policies for insurable buildings and for contents in insurable buildings. Standard policies are written on buildings in special flood hazard areas, while low-cost Preferred Risk Policies are available for most buildings located outside of mapped special flood hazard areas. For complete coverage, owners must purchase two policies: one for buildings and one for contents. A summary of coverage for both homeowners and business owners is included in the NFIP Claims Handbook. This table shows the amounts of coverage available for standard policies. The amounts of coverage are limited by law.

| Occupancy | Standard Building Coverage Limits | Standard Contents Coverage Limits |

| Single-Family Dwelling | $250,000 | $100,000 |

| 2-4 Family Dwelling | $250,000 | $100,000 |

| Other Residential Building | $500,000 | $500,000 |

| Nonresidential Building (including Business Buildings and Other Nonresidential Buildings) | $500,000 | $500,000 |

For NFIP insurance purposes, an insurable building is a walled and roofed structure, including a manufactured home. Insurable buildings are principally above ground and affixed to a permanent site. Buildings under construction may be insured. Insurance covers the building and its foundation, electrical and plumbing systems, central air-conditioning, furnaces and water heaters, refrigerators, stoves, built-in appliances, permanently installed carpeting over unfinished floors, permanently installed paneling, wallboard, bookcases and cabinets, and window treatments. Limited coverage is available for detached garages on the same parcel as an insured building. Many structures are not insurable, including gas and liquid storage tanks, water wells, septic tanks, swimming pools, tennis court and pool bubbles, fences, docks, seawalls, open pavilions, open carports, bleachers, recreational vehicles, and buildings over water built after October 1, 1982.

NFIP contents coverage is insurance for removable items inside insurable buildings, including furniture, clothing, and other personal property. Many contents are not insurable, including jewelry, artwork, furs and items valued at more than $2,500; money, precious metals, stock certificates, and valuable papers; licensed vehicles and boats; animals and livestock; and contents stored in enclosures below elevated buildings.

Who can buy flood insurance for contents?

If an owner lives in a building, the owner must have an NFIP policy for building coverage before they can buy contents coverage. On the other hand, renters may purchase contents policies even if the building owner does not have a policy on the rented building.

33. What should I know about Increased Cost of Compliance coverage?

When buildings in mapped flood hazard areas are insured by the NFIP, owners can benefit from coverage called Increased Cost of Compliance after a damaging flood. If a building is determined to be substantially damaged by flooding, this coverage helps pay to bring the building into compliance with community floodplain management regulations for new construction. A building is substantially damaged when the cost to repair the building to pre-damage condition equals or exceeds 50% of the market value of the building. See Question 36 for more on the requirements for new construction, substantial improvement and substantial damage. ICC claim payments are also available when communities adopt provisions that require certain buildings that are repetitively damaged by flooding over a 10-year period to be brought into compliance.

As of late 2018, the NFIP is authorized to pay ICC claim payments up to $30,000 toward the costs of:

- Elevating buildings on compliant foundations (see Question 36, Existing Buildings), including any freeboard required by communities

- Relocating buildings out of the mapped flood hazard area

- Demolishing buildings

- Dry floodproofing nonresidential buildings

ICC claim payments can be used as part of the non-federal cost share required by FEMA hazard mitigation grants) when those grants are used for ICC-eligible activities. See Question 10 for brief descriptions of those grant programs. Because ICC payments can be a critical part of community sponsored mitigation projects, community officials should learn about ICC before the next flood.

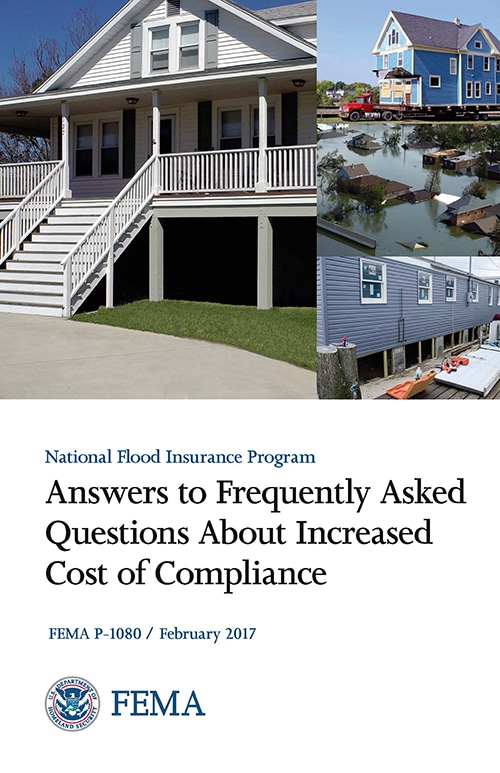

Answers to Frequently Asked Questions about ICC

FEMA P-1080 is written for policyholders and community officials. It includes a series of questions to help community officials understand what they can do to help property owners access ICC funds and their role in making substantial damage determinations, providing information, offering advice about how to bring buildings into compliance, issuing permits, conducting inspections and providing documentation requested by insurance adjusters.

FEMA P-1080 is written for policyholders and community officials. It includes a series of questions to help community officials understand what they can do to help property owners access ICC funds and their role in making substantial damage determinations, providing information, offering advice about how to bring buildings into compliance, issuing permits, conducting inspections and providing documentation requested by insurance adjusters.

34. How does the NFIP rate buildings for insurance policies?

When buildings are located in special flood hazard areas shown on FIRMs, the NFIP uses several building characteristics to "rate," or determine the cost of flood insurance premiums, starting with the construction date:

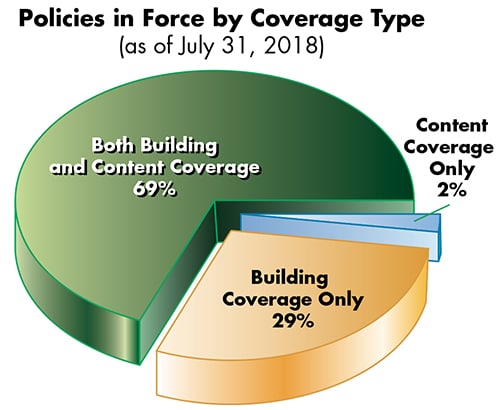

How many NFIP flood insurance policies are in force?

In August 2019, the NFIP reported nearly 5.1 million flood insurance policies were in force. Approximately16 percent of all NFIP policies are written on pre FIRM buildings, 80 percent on post FIRM buildings. Approximately 48 percent of NFIP policies are on buildings located outside of mapped special flood hazard areas and accounts for roughly 29 percent of claims paid.

- Pre-FIRM. Buildings constructed before communities adopted the flood maps (FIRMs) and regulations necessary to join the NFIP, or on or before Dec. 31, 1974, are called "pre-FIRM." The NFIP develops specific discounted rates for pre-FIRM buildings that do not depend on how high buildings may be elevated relative to the base flood elevation.

- Post-FIRM. Buildings constructed after communities adopted flood maps and regulations necessary to join the NFIP, or after Dec. 31, 1974, whichever is later, are called "post-FIRM." These buildings should have been built in compliance with the flood hazard information and regulations in effect at the time permits were issued. For post-FIRM buildings, the most significant elements used for rating flood insurance policies include:

- Date of construction

- Flood zone

- Base flood elevation (or flood depth)

- Lowest floor elevation relative to the base flood elevation

- Enclosures below the lowest floor

- Building occupancy (residential, nonresidential, condominium)

- Presence of basements

NFIP Community Rating System communities qualify for insurance discounts.

Discounts of 5-45 percent are applied to policies on buildings located in communities that participate in the NFIP Community Rating System (described in Question 43).

The final amount charged for any given policy factors in the rate data, the amount of coverage, deductibles, a federal policy fee, a reserve fund assessment, and a surcharge authorized by the Homeowner Flood Insurance Affordability Act. That surcharge is $25 on single family primary residences and $250 on other buildings.

The NFIP offers a low-cost Preferred Risk Policy for buildings located outside mapped special flood hazard areas shown on FIRMs. The average premium for these policies is $439 a year. Low rates are available until a claim is filed, after which rates increase, although the rates are still less than policies used for buildings in mapped flood zones.

35. How do flood map changes affect NFIP flood insurance?

Although FEMA, in cooperation with states, has a long-term objective of revising all flood maps, many maps have not been changed since they were originally prepared decades ago. That is usually the situation in rural communities with little pressure to develop in floodplains. When maps are revised, sometimes base flood elevations are higher, which means the mapped floodplain extends over larger areas than shown on older maps. Sometimes base flood elevations are reduced, which in turn reduces the size of mapped flood zones.

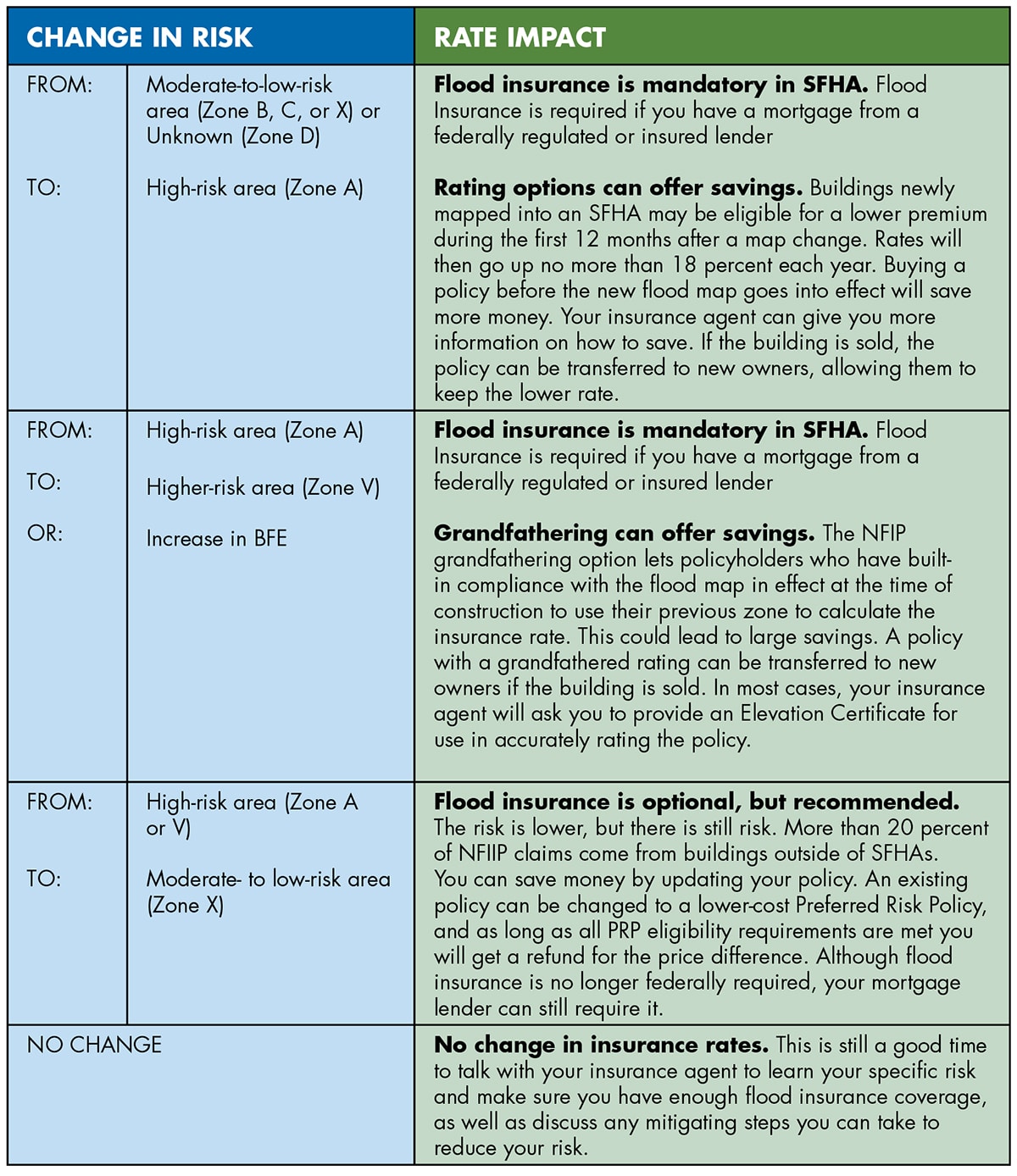

Flood map changes can affect NFIP flood insurance, both the mortgage lender's mandatory purchase requirement and how policies are rated. The table below is from the FEMA brochure Map Changes and Flood Insurance: What Property Owners Need to Know.